You see rapid changes in PTFE Membrane demand as industries worldwide embrace new technology and stricter environmental rules. The global market reached $2.75 billion in 2023 and keeps growing, with industrial filtration, water treatment, and ePTFE Protective Vent solutions leading the way. Many choose ePTFE Membrane for reliable performance.

Key Takeaways

- PTFE membranes offer unique benefits like strong chemical resistance, thermal stability, and durability, making them ideal for many industries including healthcare, automotive, and electronics.

- Demand for PTFE membranes is growing worldwide, driven by stricter environmental rules, technological innovation, and expanding applications in medical, automotive, packaging, and construction sectors.

- Advances in PTFE membrane technology and sustainability efforts help companies meet regulations, reduce costs, and create customized solutions for emerging market needs.

PTFE Membrane: Core Properties and Advantages

Unique Characteristics of PTFE Membrane

You benefit from PTFE Membrane’s remarkable physical and chemical properties. These features set it apart from other membrane materials:

- Chemical resistance shields the membrane from strong acids, bases, and organic solvents.

- Thermal stability lets you use it in extreme temperatures, from -200°C to +260°C.

- Hydrophobicity keeps water from wetting the surface, which prevents pore blockage.

- Precise pore size control and high porosity deliver excellent filtration and permeability.

- Low friction surfaces reduce fouling and make cleaning easier.

- Durability ensures a long lifespan, even under harsh conditions.

- Biocompatibility supports safe use in medical and pharmaceutical settings.

PTFE Membrane’s unique structure, with strong carbon-fluorine bonds, gives you a material that resists aging, UV damage, and embrittlement. Compared to polypropylene or polyethersulfone, you get superior chemical and thermal resistance.

Benefits Driving Industrial Adoption

You see PTFE Membrane used across many industries because of its outstanding performance. The chemical structure, with fluorine atoms protecting carbon bonds, provides anti-adhesion properties and reduces fouling. This means less maintenance and longer service life.

| Characteristic | Industrial Sector | Performance Benefit |

|---|---|---|

| Chemical resistance | Chemical processing | Protects against corrosion and harsh chemicals |

| Thermal stability | Electronics, Automotive | Maintains function at high temperatures |

| Hydrophobicity | Filtration, Energy | Improves separation efficiency and water repellency |

| Mechanical strength | Construction, Aerospace | Delivers durability and long-lasting performance |

You gain efficiency and product quality. For example, PTFE Membrane achieves high salt and oil rejection rates in separation processes. Its self-cleaning and fire-resistant properties also improve safety and reduce operational costs.

PTFE Membrane Demand Trends by Industry

Medical and Healthcare Applications

You see strong growth in the medical and healthcare sector as hospitals and clinics expand. PTFE Membrane supports advanced wound care, surgical drapes, drug delivery, and implantable devices. The aging population and rising chronic diseases increase demand for reliable, biocompatible membranes. You benefit from innovations like AI and IoT, which improve manufacturing and product performance. Sustainability and digital transformation also shape the market.

- Demand rises steadily due to healthcare infrastructure growth.

- Aging populations drive higher usage of medical membranes.

- Advanced filtration and biocompatibility support wound care and implants.

- North America leads the market, but Asia Pacific grows fastest.

- Customization and automation help you meet diverse needs.

- Regulatory standards and government incentives encourage innovation.

| Aspect | Details |

|---|---|

| Market Size 2024 | USD 450 Million |

| Projected Market Size 2033 | USD 800 Million |

| CAGR (2026-2033) | Approximately 7.5% |

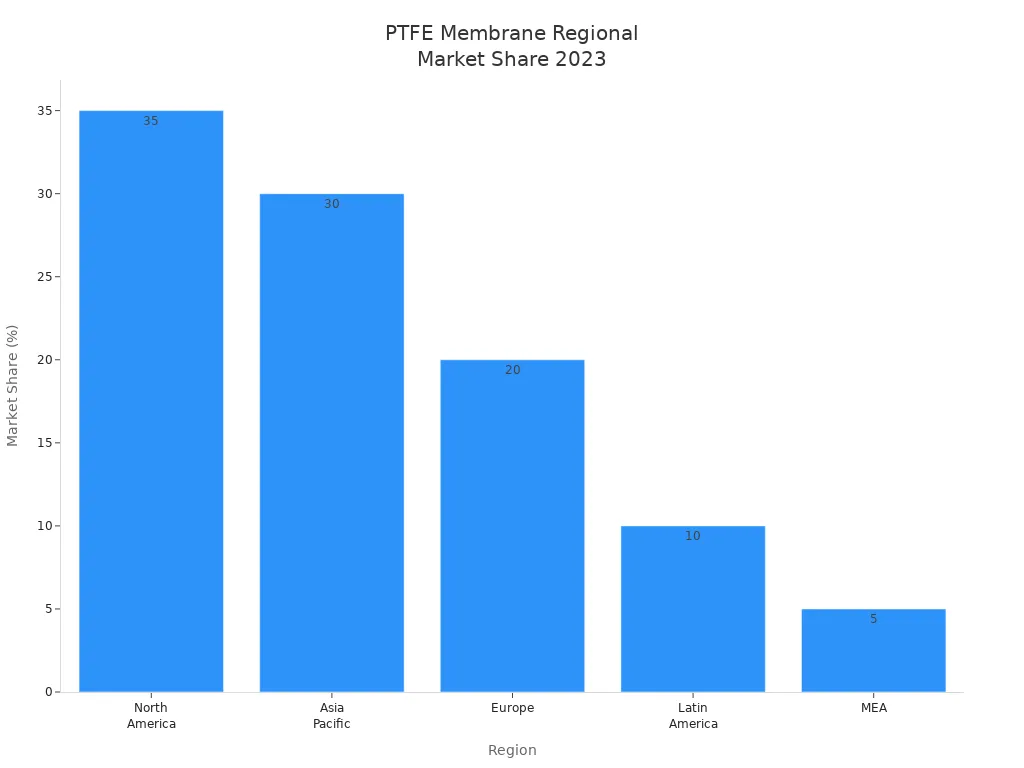

| Regional Market Share 2023 | North America: 35%, Asia Pacific: 30%, Europe: 20%, Latin America: 10%, MEA: 5% |

| Fastest Growing Region | Asia Pacific (8.5% CAGR) |

| Key Applications 2023 | Hospitals: 60%, Clinics: 30%, Others: 10% |

| Demand Drivers | Chronic diseases, infrastructure expansion, patient safety emphasis |

You gain from PTFE Membrane’s biocompatibility, chemical resistance, and mechanical strength, which are essential for safe and effective medical devices.

Automotive and Transportation Uses

You rely on PTFE Membrane for venting and filtration in automotive and transportation systems. The shift toward electric vehicles (EVs) and advanced driver-assistance systems (ADAS) increases the need for high-performance membranes. These membranes manage pressure and moisture in battery packs, fuel tanks, and cabin air filters, ensuring safety and longevity.

- Automotive and electronics sectors drive market revenue.

- Electric vehicles and ADAS boost demand for advanced membranes.

- Strict safety and environmental rules encourage adoption.

- Asia-Pacific shows the highest growth due to rapid industrialization.

| Aspect | Details |

|---|---|

| Applications | Venting in fuel tanks, battery packs, transmission housings, cabin air filters |

| Key Properties | High thermal stability, chemical resistance, low friction |

| Importance in EVs | Pressure and moisture management for battery safety |

| Market Value (2023) | $0.36 billion |

| Market Projection (2032) | $0.7 billion |

| Growth Drivers | Environmental regulations, safety demands, EV adoption |

| Regional Trends | North America, Europe lead; Asia-Pacific grows rapidly |

You benefit from PTFE Membrane’s ability to withstand harsh automotive environments, supporting both traditional and electric vehicles.

Electronics and Semiconductor Growth

You see PTFE Membrane gaining popularity in electronics and semiconductor manufacturing. Its excellent dielectric properties, chemical resistance, and thermal stability make it ideal for wafer processing, chemical delivery, and packaging. The Asia-Pacific region, especially China, Taiwan, South Korea, and Japan, leads adoption due to a high concentration of semiconductor facilities.

PTFE Membrane helps you control contamination and achieve high-purity filtration, which is critical for semiconductor fabrication. The market grows as you invest in new fabs and advanced manufacturing. The United States and Europe also contribute, driven by research and regulatory support. You benefit from technological advancements and automation, which expand the use of PTFE Membrane in this sector.

Packaging and Food Processing Expansion

You use PTFE Membrane in packaging and food processing to control moisture and gas exchange. This prevents spoilage and extends shelf life. The demand for safe, long-lasting food and pharmaceutical products drives adoption. PTFE Membrane is common in modified atmosphere packaging (MAP) and active packaging, helping you maintain product integrity.

- PTFE Membrane supports venting solutions for packaging.

- You meet regulatory requirements for food and pharmaceutical safety.

- Innovations in membrane design improve gas permeability and barrier properties.

- Sustainability efforts focus on eco-friendly venting options.

- North America and Europe dominate, but Asia-Pacific grows quickly.

The market for PTFE venting in packaging is projected to reach $42 million by 2025, with a CAGR of 3.3% from 2025 to 2033. The food and beverage segment remains a key contributor.

Construction and Building Materials Integration

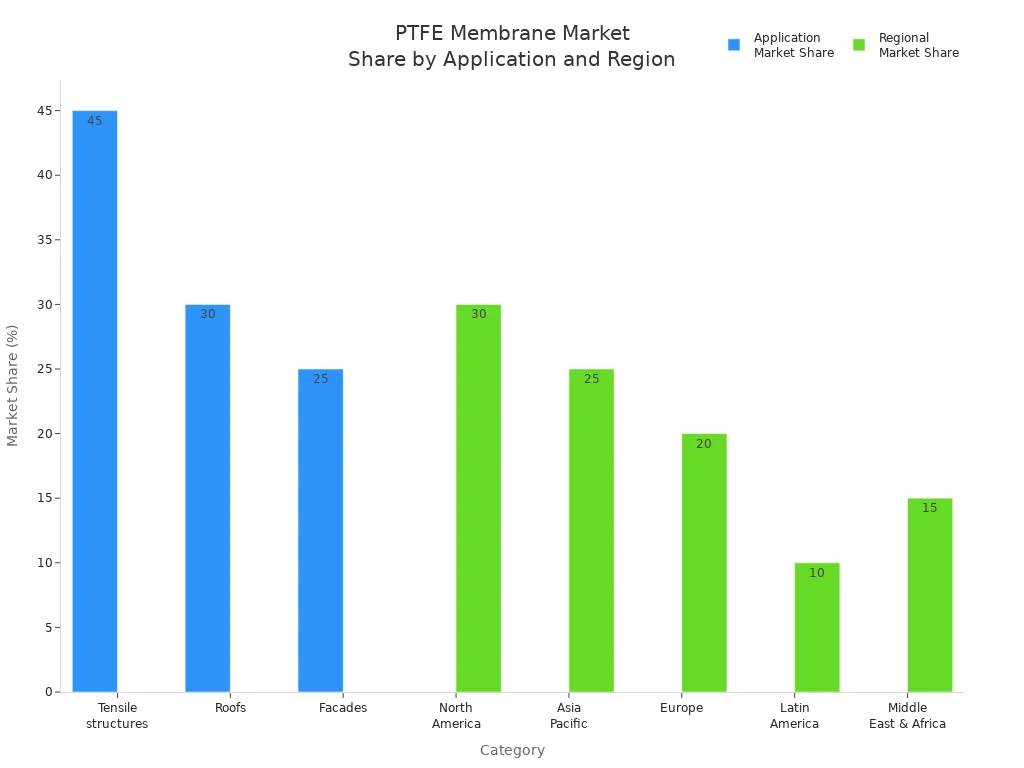

You see PTFE Membrane used in modern construction for tensile structures, roofs, facades, and canopies. Its durability, weather resistance, and self-cleaning properties make it valuable for stadiums, airports, and commercial buildings. The demand for sustainable, energy-efficient materials drives growth, especially in Asia-Pacific.

| Category | Details |

|---|---|

| Main Applications | Tensile structures, roofs, facades, canopies, skylights, sports facilities, commercial buildings |

| Properties Valued | Durability, weather resistance, UV resistance, fire retardancy, lightweight, flexibility |

| Market Outlook | Positive growth, driven by sustainability and innovation |

| Fastest Growing Region | Asia Pacific, fueled by infrastructure development |

| Market Growth Forecast | CAGR 8% to 8.9% (2023-2033), market size to reach USD 2.5 billion by 2033 |

| Demand Drivers | Urbanization, green building trends, stricter regulations |

You gain from PTFE Membrane’s long lifespan and low maintenance, which support green building certifications and smart architecture.

Apparel and Textile Innovations

You experience major innovations in apparel and textiles thanks to PTFE Membrane. Early water-repellent coatings have evolved into advanced expanded PTFE (ePTFE) membranes that combine waterproofing with breathability. PTFE fibers now create fabrics that resist water and stains, while nanotechnology enables self-cleaning and thermal regulation.

PTFE Membrane supports high-performance outdoor apparel, protective clothing, and medical textiles. You see growth in smart textiles, which offer energy harvesting and wearable technology. The global PTFE fabric market reached $1.2 billion in 2020 and is projected to hit $1.8 billion by 2026. The PTFE Waterproof Breathable Membrane Market is valued at $2.8 billion in 2024 and could reach $4.5 billion by 2033.

You benefit from durable, high-performance, and sustainable textiles. Regulatory focus on worker safety and green building supports further adoption. Leading companies invest in R&D to improve PTFE properties and sustainability.

Regional Shifts in PTFE Membrane Demand

North America Market Dynamics

You see North America leading the global PTFE membrane market, holding about 35-40% of the total share. Several factors drive this dominance:

- Strict regulations and sustainability standards increase the need for wastewater treatment and water filtration.

- Emission control laws in the U.S. and Canada push industries to adopt advanced filtration solutions.

- The food and beverage sector expands, raising demand for filtration and separation processes.

- Major investments by companies like Cytiva boost production capacity and innovation.

- Strong industries such as automotive, aerospace, and chemical processing rely on PTFE membranes for their superior chemical resistance and durability.

The U.S. remains the largest market in the region. You benefit from a projected CAGR of 5.0% through 2030, with rising demand in automotive, electronics, healthcare, and industrial sectors.

Europe’s Regulatory and Sustainability Focus

| Country | Regulatory and Sustainability Initiatives Impacting PTFE Membrane Demand and Adoption |

|---|---|

| EU-wide | Harmonized regulations and sustainability mandates drive eco-conscious and energy-efficient PTFE membrane solutions. Strong government backing and EU funding promote innovation. |

| Germany | Industry 4.0 support, R&D funding, and sustainable practices enhance PTFE membrane application efficiency. |

| France | Aggressive green innovation goals and public investment programs foster partnerships and support EU climate strategies. |

| Italy | Recovery and resilience programs accelerate smart and sustainable technology integration, especially in SMEs. |

| United Kingdom | Digital infrastructure support and regulatory reforms post-Brexit increase market agility and drive innovation in PTFE membrane technologies. |

You notice that Europe’s focus on sustainability and regulatory compliance encourages the adoption of energy-efficient and eco-friendly PTFE membrane solutions. Government support and funding help you access innovative products and technologies.

Asia-Pacific’s Rapid Industrialization

You witness rapid industrialization in Asia-Pacific, making it the fastest-growing region for PTFE membrane demand. The region now leads with over 35% of the global market share. Key drivers include:

- Urbanization and regulatory reforms focused on safety and emissions control.

- Rising investments in advanced manufacturing sectors.

- Expanding industries such as industrial filtration, electronics, aerospace, pharmaceuticals, and chemical processing.

Countries like China and India play a major role in this growth. You benefit from increased access to advanced filtration and separation technologies as infrastructure and manufacturing expand.

Emerging Markets and New Opportunities

You find significant new opportunities for PTFE membrane manufacturers in emerging markets, especially in Asia-Pacific. China and India show rapid growth in pharmaceutical manufacturing and water purification infrastructure. The PTFE membrane capsule filter market is projected to grow from $2.5 billion in 2023 to $3.8 billion by 2028, with a CAGR of 8.5%. Growth is driven by stricter regulatory compliance, expansion in the biopharmaceutical industry, and technological innovation. As industrialization and infrastructure development continue, you can expect even greater demand for advanced filtration solutions.

Key Drivers and Challenges in the PTFE Membrane Market

Technological Advancements and Product Innovation

You see rapid progress in PTFE membrane technology as manufacturers invest in research and development. These advancements help you meet stricter industry requirements and open new application areas. Recent innovations include:

- Hydrophilic membranes that improve water permeability and filtration, especially for medical and industrial uses.

- Oleophobic membranes that resist oil and increase durability, which is important in food processing and petrochemical industries.

- Composite and multi-layer membranes tailored for specific needs, expanding performance capabilities.

- Nano-engineered and expanded PTFE (ePTFE) technologies that boost hydrophobicity and porosity, enabling better gas filtration and venting.

- High-density PTFE membranes for medical and pharmaceutical applications, such as sterile venting and tissue barriers.

- Smart membrane coatings and integration with digital technologies, broadening the range of uses.

- Manufacturing process improvements that focus on sustainability and performance under extreme conditions.

You benefit from these innovations through improved filtration efficiency, better chemical resistance, and more reliable products. Companies in North America and Europe lead with new technologies, while Asia-Pacific focuses on large-scale production. Leading firms invest heavily in R&D to stay ahead in the market.

| Aspect | Evidence Summary |

|---|---|

| Market Growth | The PTFE membrane market is expected to reach USD 2.05 billion by 2031, with a CAGR of 7.5% (2025-2031). |

| Technological Innovations | AI-driven analytics, IoT systems, and robotic automation enhance manufacturing and reduce costs. |

| Industry Applications | Medical devices, electronics, automotive, chemical processing, and energy sectors drive demand. |

| Regional Dynamics | North America leads in tech; Europe focuses on sustainability; Asia-Pacific grows through industrialization. |

| Innovation Impact | Product performance, cost-efficiency, and adaptability improve, meeting regulations and expanding applications. |

| Collaboration Ecosystem | Startups, academia, and R&D centers work together to create sustainable technologies and resilient infrastructure. |

You gain a competitive edge by adopting the latest PTFE membrane technologies, which help you comply with regulations and deliver high-quality solutions.

Regulatory Pressures and Environmental Concerns

You face increasing regulatory pressures as governments worldwide enforce stricter environmental standards. These regulations push you to adopt advanced filtration technologies and reduce hazardous substances in your processes. For example, the RoHS and WEEE directives require you to limit the use of harmful chemicals and manage electronic waste responsibly. The European Union’s green transition policies encourage you to use energy-efficient and environmentally friendly materials.

- You must comply with global environmental regulations, which drive demand for PTFE membranes in filtration and purification.

- PTFE membranes help you filter out particles, microorganisms, and chemicals, supporting compliance with strict standards.

- Governance frameworks now include data privacy and international trade compliance, shaping your R&D and production strategies.

- Environmental, Social, and Governance (ESG) criteria influence your business decisions, making sustainability a top priority.

You see these regulatory pressures affecting manufacturing and usage across North America, Europe, and Asia-Pacific. As a result, you need to stay updated on changing rules and invest in technologies that help you meet new requirements.

Sustainability and Green Manufacturing Trends

You notice a strong shift toward sustainability in PTFE membrane manufacturing. Many companies have phased out persistent organic pollutants like PFOA, showing a commitment to greener production. PTFE’s durability and long lifespan reduce waste and resource use, which supports your sustainability goals.

- PTFE membranes contribute to energy efficiency in buildings, helping you meet green building standards such as LEED.

- Self-cleaning properties reduce the need for harsh chemicals and water, lowering your environmental impact.

- Mechanical recycling and chemical recycling methods help you reuse manufacturing waste, though economic and technical challenges remain.

- PTFE plays a key role in green hydrogen production, supporting decarbonization and renewable energy initiatives.

- Global policies, such as the EU Hydrogen Strategy, drive demand for PTFE-based components in clean energy systems.

You benefit from ongoing research into recycling technologies and greener production methods. Leading companies innovate with new PTFE formulations and coatings to enhance sustainability and performance. As you adopt these trends, you help shape a more responsible and eco-friendly industry.

Cost, Competition, and Supply Chain Issues

You encounter several challenges related to cost, competition, and supply chain management in the PTFE membrane market. Supply chain volatility, especially in the Asia-Pacific region, can disrupt your operations and limit growth. High capital intensity and concerns about return on investment make cost control essential for your business.

- Intense competition exists among major manufacturers, who expand their product lines and regional presence to meet local demand.

- Mergers, partnerships, and joint ventures help companies strengthen their market positions and share resources.

- Regulatory hurdles and capital requirements add complexity to your operations and influence your growth strategies.

You must balance the need for innovation with cost efficiency and supply chain resilience. By investing in advanced manufacturing and building strong partnerships, you can overcome these challenges and maintain your competitive edge.

Future Trends and Opportunities for PTFE Membrane Manufacturers

Expansion into New Application Areas

You will see new opportunities as industries demand advanced filtration and separation. Regulatory pressure for clean water and air drives growth in water and wastewater treatment. Medical and pharmaceutical sectors need sterile barriers and precise filtration. The electronics industry seeks membranes for miniaturized, high-performance devices. Other sectors, such as automotive and aerospace, use membranes for specialized needs. You can expect demand to rise in power, food and beverage, and chemical processing as these industries require processed water and improved purity.

- Water and wastewater treatment

- Air filtration and gas separation

- Medical devices and pharmaceuticals

- Electronics packaging

- Automotive and aerospace applications

Customization and High-Performance Solutions

You can meet emerging industry needs by offering custom-engineered membranes. Manufacturers now use nanotechnology to improve selectivity, permeability, and lifespan. Eco-friendly, solvent-free processes support sustainability goals. You benefit from membranes tailored for chemical resistance, precise pore size, and high durability. Automation and precision machining help you deliver consistent quality. These solutions meet strict regulatory standards and unique customer requirements in renewable energy, biotechnology, and water treatment.

- Nanotechnology integration for better performance

- Sustainable manufacturing methods

- Custom designs for specific industry needs

- Automation and data analytics for quality control

Strategic Partnerships and Global Market Expansion

You gain a competitive edge by forming strategic partnerships with industry leaders, research institutions, and government bodies. These alliances drive innovation and help you enter new markets. By sharing resources and expertise, you can develop advanced PTFE membrane products for specialized applications. Partnerships also support geographic expansion and product diversification, helping you address regulatory challenges and changing consumer demands.

Strategic collaborations strengthen your global presence and position you for long-term growth in the evolving PTFE membrane market.

You see PTFE Membrane demand rising as industries seek advanced filtration, sustainability, and reliable performance. Global collaboration and digital innovation drive new applications in healthcare, water treatment, and electronics. By embracing technology and adapting to evolving markets, you position your business for long-term growth and leadership in this dynamic sector.

FAQ

What industries benefit most from PTFE membranes?

You see PTFE membranes used in healthcare, automotive, electronics, construction, and textiles. These industries value durability, chemical resistance, and advanced filtration.

How does PTFE membrane support sustainability goals?

You reduce waste and energy use with PTFE membranes. Their long lifespan and self-cleaning properties help you meet green building and manufacturing standards.

Can you customize PTFE membranes for specific applications?

Yes, you can request custom PTFE membranes. Manufacturers offer tailored pore sizes, thickness, and composite structures to meet your unique industry requirements.

Post time: Aug-06-2025